Quantum Untangled - Cutting through the hype

When will quantum be 'good enough' for companies to adopt en-masse?

London’s Tobacco Docks more than lived up to its name in the Victorian era. Here in deepest Wapping resided a mecca for the city’s pipe and cigar merchants, its warehouses housing tens of thousands of hogsheads, each bale protected by an army of 300 cats watching for rats or mice. Below ground lay the cellars, capable of storing at least eight million gallons of wine, port, sherry, rum, and brandy – enough, perhaps, to keep the pubs open for a very merry week and a half.*

The Tobacco Docks’ original calling disappeared in a puff of smoke decades ago. Nowadays these cavernous halls serve as an events space, a place where business executives of all stripes can pitch and present on any topic that justifies renting a vast and majestic relic of Victorian industry. Last week it was, you will be surprised to hear, quantum computing, with lectures and panels on everything from government and financial institutions’ interest in the technology and its interactions with artificial intelligence to a well-attended and very well-presented panel on quantum ethics presented by moi.

But aside from the magisterial conversation to be had on guardrails for this exotic computational platform, the talk that really stuck in my brain was given by Dimitrios Emmanoulopoulos, head of machine learning for Barclays. What he was interested in, it emerged, was not only the raw potentiality of quantum computing, but what his bank could do with it in the here and now.

Practical magic(al thinking)

The answer? Not much. Emmanoulopoulos agreed with the idea that there are certain optimisation problems and calculations that do require the absolute fastest tools on the market. The problem for quantum, however, is that the technology isn’t yet capable of solving these problems at scale. What’s more, the demand to attack these challenges isn’t strong yet. “Based on the current benchmarks that we have done, there are very, very few use cases that really require… the latest and greatest of the optimizers offered with current quantum technology,” he told delegates.

What’s more, state-of-the-art classical computing optimisers already exist to solve the kinds of problems faced at banks like Barclays. Most of these mathematical challenges have a few hundred variables and constitute relatively straightforward optimisation problems. That reliance on classical supercomputers might change when their quantum counterparts marshall a few thousand logical qubits, said Emmanoulopoulos – but, for now, the tech’s limitations in this respect mean that he’s mainly interested in tinkering with the latest machines “as an R&D function.”

Changing his mind and other financial technologists like him, said Emmanoulopoulos, would require quantum computing to reach the mysterious “good enough” threshold for the banking sector. What that means, in so many words, is that for a bank to really consider shaping key services around a quantum computer, it has to perform operations more quickly, efficiently and cheaper than a classical supercomputer. So far, so straightforward, but even when quantum computing has reached this moment – which, to paraphrase the supreme court judge talking to the attorney, may be vague but you’ll ‘know it when you see it’ – it’s not as if an institution like Barclays will wholeheartedly embrace it. Rather, argued Emmanoulopoulos, there’ll be a wait and see period among major financial institutions as banks see which among them will transition from an experimental liaison with quantum to something a little more, uh, long-term.

“We cannot adopt in a production environment a technology that runs for two months, even if it's the greatest,” said Emmanoulopoulos. “We are going to need time to acquire it once quantum computers become commercially available. So, it's not going to be the very first part of the, let's say, ‘tier one’ customer-facing applications that are going to use quantum computers.”

Party pooping on the quantum hype train

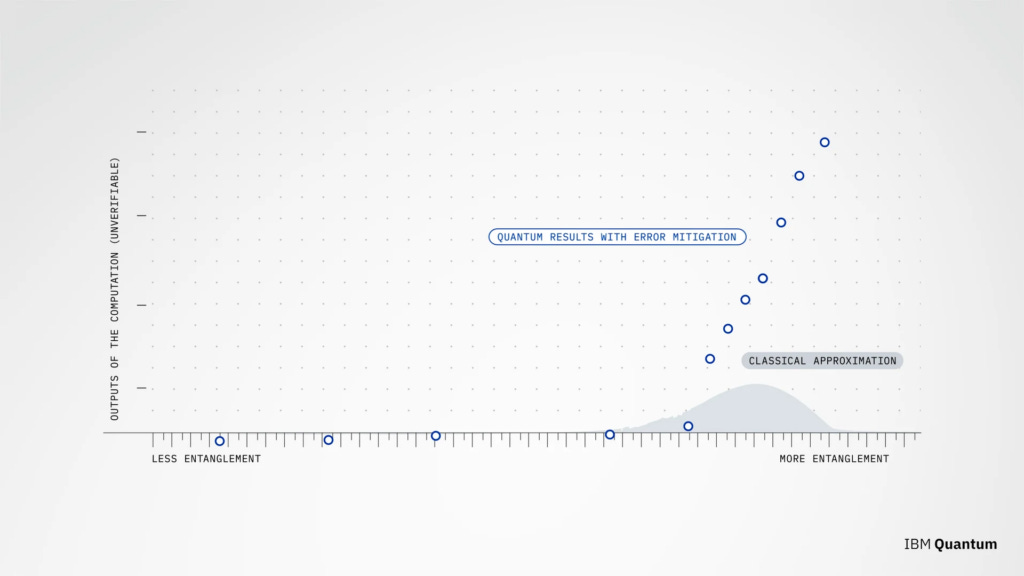

IBM and others are busy pushing the idea that we have now entered the era of quantum utility – the point where a quantum computer can perform some tasks better than a classical computer. And, to be sure, this is something Big Blue recently demonstrated with a material simulation problem. But these are just early examples and rely on error mitigation happening faster than errors appear. Elsewhere, the real-world applications are still relatively limited.

While the immediate use cases might be restricted to experiments or reserved for rare edge examples, as Emmanoulopoulos suggests, my thoughts are that this phase will be short-lived. Recent years, after all, have seen a long list of breakthroughs in the field, whether that’s in IBM and Google enhancing error mitigation, the work by Quantinuum on topological qubit control, or ORCA using photonic processors to supplement GPUs in generative AI. As error mitigation improves and enough qubits are squeezed on a chip to create real, useful logical qubits, I believe that even those mainstream problems mentioned by Barclays will come within the scope of the quantum realm.

Even so, Emmanoulopoulos’ talk is a useful reminder of how those at the frontline of enterprise tech approach the practicality and risks associated with quantum tech. It’s easy to forget while reporting on the latest breakthrough in error correction or quantum chips that maintaining the balance between risk and reward in adopting new technologies is not easy for even major financial institutions.

*No actual maths was used in the creation of this sentence

—-

The Best of the Rest

It’s been a busy week in quantum coverage for Tech Monitor…

Intel launches 12-qubit ‘Tunnel Falls’ quantum chip and reveals plan for $4.6bn Poland factory

This is the news that the chip giant has launched its own QPU using quantum dot technology. The move is intended, Intel says, to help build the groundwork for the ‘quantum leap’ towards commercial applications expected within the next five years.

£54m pledged for UK quantum research

The UK is splashing the cash on quantum this year, announcing another tranche of funding for research in the field. Just under half of this gigantic wad of cash will go to fund projects building quantum-enabled PNT applications.

IBM quantum machine beats supercomputer

And finally, Big Blue’s got something else to boast about. Last week, IBM announced that its 127-qubit quantum computer outperformed a classical supercomputer in simulating the properties of matter — another sign, says the firm, that the era of quantum utility is close at hand.

Partner content

How do we restore trust in the public sector? - The New Statesman

Defining a Kodak culture for the future - The New Statesman

Brands must seek digital fashion solutions - Tech Monitor

Green bonds and the urban energy transition - Capital Monitor